If you are looking to buy a new truck, then it pays to know if you are ordering from a major player or an also ran. To help you out, here are some bang up-to-date statistics, published by the Society of Motor Manufacturers and Traders (SMMT). The market is down this year, but companies have been struggling to get components to build their trucks – so much so that MAN shut down two major factories for weeks due to the crisis in Ukraine. So there is a shortage in supply, but also there is a little nervousness about the near future and some investment decisions – like ordering a brand new truck – may be shelved and a used truck sought instead.

Q1 2022 Down

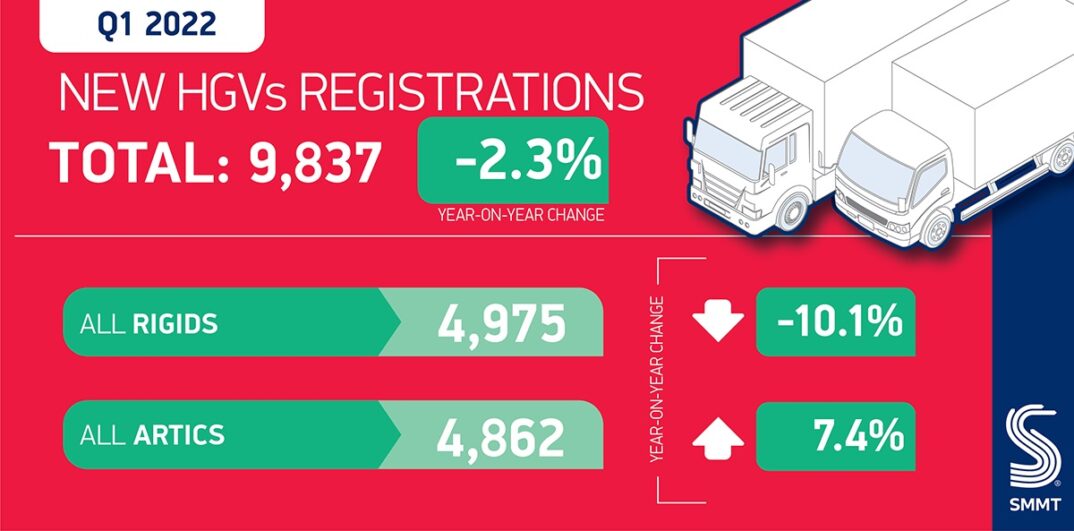

UK heavy goods vehicle (HGV) registrations declined by -2.3% to 9,837 registrations in the first quarter of 2022. The decline saw 9,837 units registered in Q1, down 227 on a volatile first quarter in 2021, with the sector still some distance from a full recovery from the pandemic at -17.1% below Q1 2019.1 While demand for HGVs, particularly from the construction industry, has remained robust, global shortages of semiconductors and raw materials, including steel and aluminium, have restricted vehicle deliveries to fleet operators.

Rigids Down – Tractor Units Up

Registrations of rigid trucks fell by -10.1% to 4,975, accounting for just over half (50.6%) of the market, while those of articulated trucks rose by 7.4% to 4,862 units. There was increased demand for tractors, the largest segment by volume, up 8.3% and comprising 49.1% of the market. However, all other segments saw decline, including box vans (-13.7%), tippers (-16.0%), curtain-sided trucks (-12.4%) and refuse disposal vehicles (-31.3%). Fleet renewal cycles are more visible in these lower volume segments, with registration levels more likely to be artificially impacted by supply shortages.

Demand Across the UK

Across the UK nations, uptake varied considerably. Around four in five new trucks were registered in England, which recorded a decline of -2.8%, while registrations in Scotland fell by -14.0%. Northern Ireland and Wales registered 40.8% and 8.7% more HGVs than the same period last year respectively, although they made up a combined total of only 6.3% of UK registrations.

Mike Hawes, SMMT Chief Executive, said, “Despite the myriad challenges facing the heavy goods vehicle sector, manufacturers have remained resilient, striving to fulfil order books as quickly as possible amid robust demand for the latest technology trucks. Despite the market’s post-pandemic recovery continuing to be frustrated by supply chain shortages and disruptions, HGV operators considering their next fleet investments are encouraged to move early to secure the new vehicles that will meet their business needs. The sector continues to play a crucial role in the UK economy and faces the same decarbonisation challenges as the rest of road transport. The government’s newly announced zero emission HGV demonstrator programme will provide useful guidance to help operators plan their longer term fleet strategy.”

So Who has Sold the Most Trucks?

DAF remain at the top of the table for registrations of trucks over 6 tonnes GVW as they have for over a decade now. This percentage share has slipped slightly but remains just below the 30% mark. If you are looking to buy a new truck, then the market leader is usually a good place to start.

In terms of number of registrations, there is nothing between the two Swedish manufacturers, Scania and Volvo. These two manufacturers have benefited this quarter – they are the tractor unit specialists in the UK and have seen their core market segments grow, whilst those more involved in rigid trucks have seen their numbers fall. Volvo’s share have gone from 12% at the end of 2021 to over 16% for Q1 this year!

When there are winners in market share, there are always losers. Just a few years ago, Mercedes were flying high in the market share table – back in 2015 they were as high as 18% of the market in second place behind DAF. Q1 this year saw the German giant with just under 10% market share.

MAN have struggled in Q1 thanks to their factory closure, but hopefully this means that Q2 will involve a lot of catching up and see their figures return to their normal 10% share of the market.

Looking at Iveco, this is a company that has made the largest market share gains over the last few years. Their gas truck strategy – plus offering 7.2 tonne panel vans may well be paying off and could see the business continue to make inroads in the face of increasing fuel costs.

Finally, towards the bottom of the table you might think that the manufacturers are not worth considering – this would be a mistake as they specialise in their own areas. Both Isuzu and Mitsubishi Fuso have lightweight 7.5 tonners which mean that a decent payload can be achieved whilst still being driven on a car licence (for older drivers). Dennis Eagle too are highly specialist with their focus on refuse truck applications.

| Position | Manufacturer | Q1 2022 | Q1 2021 | Q1 22 Vs 21 | % Share Q1 22 |

|---|---|---|---|---|---|

| 1 (1) | DAF Trucks | 2919 | 3142 | -7.1% | 29.67% |

| 2 (2) | Scania | 1616 | 1582 | 2.1% | 16.43% |

| 3 (3) | Volvo | 1609 | 1400 | 14.9% | 16.36% |

| 4 (5) | Mercedes | 941 | 1021 | -7.80% | 9.57% |

| 5 (4) | MAN | 875 | 1082 | -19.10% | 8.89% |

| 6 (6) | Iveco | 824 | 792 | 4.00% | 8.38% |

| 7 (7) | Renault Trucks | 537 | 494 | 8.70% | 5.46% |

| 8 (8) | Isuzu | 259 | 192 | 34.90% | 2.63% |

| 9 (9) | Dennis Eagle | 202 | 247 | -18.20% | 2.05% |

| 10 (10) | Fuso | 55 | 112 | -50.90% | 0.56% |

| TOTAL | 9837 | 10064 | -2.3% | 100% |