Second Consecutive Year of Growth in Truck Sales

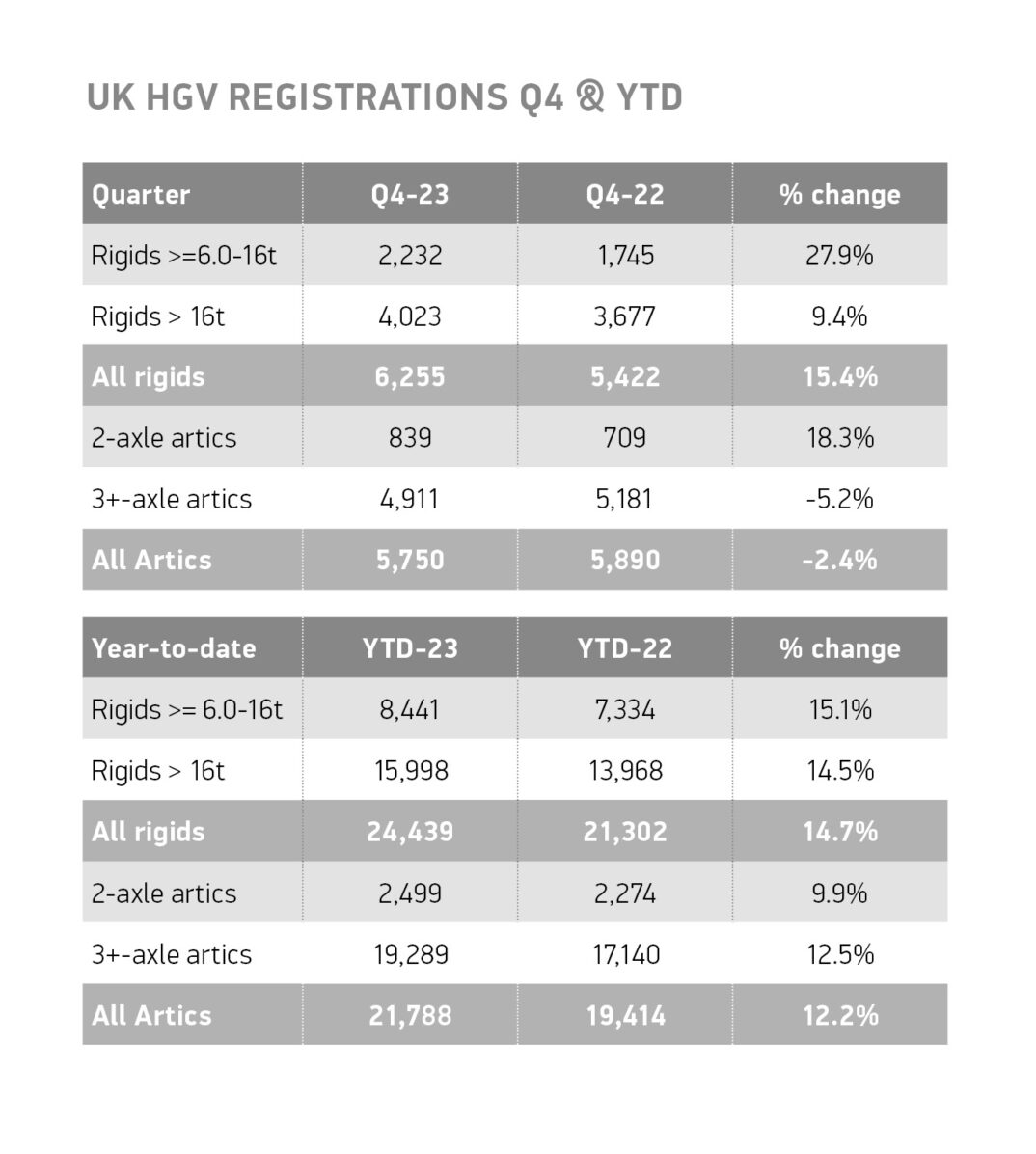

The headline SMMT figures for the full year of 2023 show the excellent news that truck sales and registrations were up almost across the board with a total of 46,227 units. the final quarter’s data did start to indicate some more worrying trends as far as the UK’s truck market and UK plc. as a whole are concerned. Q4 saw a fall in the registrations of 6×2 tractor units for the first time in 2023. The 44 tonne 6×2 tractor unit is the most popular type of truck in the UK and is a great early indicator of the trend of the overall market. Since a tractor unit does not require a complex built time for its body like most rigids, sales of tractor units are usually the first to fall and the first to increase. This normally gives us an idea of overall market direction.

Although 6×2 tractor units were up 12.5% for the year, Q4 saw a drop in registrations down 5.2%.

Construction Sector Down

Worth keeping an eye on is the year-long poor performance of the tipper segment with registrations down -9.2% in 2023. A strong indicator of the confidence in the construction sector, the UK’s tipper market was impacted by the Government’s decision to shelve the next phase of construction for HS2. It may also be an indicator of the overall construction industry.

News Positive Overall

It is easy to be a doomsayer, but there is much to be positive about. This is the seventh quarter in a row that the truck industry has increased registrations with the total the highest since 2019 (48,535) and the numbers of electric trucks being registered have tripled compared to 2022.

The Best Selling Trucks in 2023

Scania is 2023 Best Seller

The undoubted star of the show for 2023 was Scania. With a growth rate well over twice that of the market overall at 33%, the Swedish manufacturer not only stole second place in the new truck market from fellow Swede Volvo Trucks it did so by a significant margin, coming from 350 registrations behind to a total of around 1,000 truck registrations more than Volvo. This success increased Scania’s market share from 13.9% to 16.3% inside a twelve month period.

DAF Trucks Down

Two of the major players had a relatively poor final quarter compare to their 2022 efforts. were behind the new truck market overall. Mercedes were down -5.6% for the quarter which pulled the company down below the market average of 13.5% to just 9.6%. The more significant news is the -12.4% drop in DAF truck registrations. There has not been many occasions in recent memory that DAF have underperformed the market by such a significant amount. This can be explained in part by a strong performance in 2022 where Q4 saw DAF with over 33% or the market and also thanks to a number of model changeovers taking place with the new DAF range still rolling out.

DAF fans need not lose any sleep, as the UK assembler of trucks maintained their 30% market share for the full year – albeit percentage points down on 2022.

Let’s look at the manufacturers’ table for the full year 2023:

UK Truck Registrations 2023

| Position | Marque | 2023 | 2022 | % Change |

|---|---|---|---|---|

| 1 | DAF | 13885 | 13068 | 6.3% |

| 2 | Scania | 7519 | 5655 | 33.0% |

| 3 | Volvo | 6522 | 5906 | 10.4% |

| 4 | Mercedes | 5248 | 4788 | 9.6% |

| 5 | MAN | 3919 | 3324 | 17.9% |

| 6 | Iveco | 3865 | 3387 | 14.1% |

| 7 | Renault Trucks | 2908 | 2598 | 11.9% |

| 8 | Isuzu | 1198 | 970 | 23.5% |

| 9 | Dennis Eagle | 878 | 815 | 7.7% |

| 10 | Fuso | 281 | 205 | 37.1% |

| 11 | Volta | 4 | 0 | N/A |

| TOTAL | 46,227 | 40,716 | 13.5% |

The Best-Selling Electric Trucks 2023

A growing choice of new electric truck models means that truck buyers are trialling zero emission trucks, with electric and hydrogen registrations up more than threefold in 2023 – by 265.6% to 234 units. While this is progress, these vehicles account for just 0.5% of the market and the clock is ticking with the end of sale of new, non-zero emission trucks under 26 tonnes coming in 2035. Meanwhile, with less than one full cycle of truck fleet renewal remaining before 2035, it is imperative that government sends the signal to the market that the shift to zero emission vehicles must accelerate. Businesses that fail to do so risk delaying the benefits of decarbonisation, putting a smooth, stable transition of the market in jeopardy.

Mike Hawes, SMMT Chief Executive, said, “Two years of growing demand for the very latest, fuel efficient trucks amid testing times reflects these vehicles’ importance to the British economy – and with some HGVs facing the same 2035 end of sale date as cars and vans, the sector is also critical to our green goals. Increasing availability of electric and hydrogen models – and record demand for them – is encouraging market growth but operators need cast-iron confidence to switch. More than ever, government must compel truck infrastructure rollout and provide a signal that the time to invest is now.”