Unlike for trucks, you can easily find the list price of a car. These are published online and automatically change when you build your own specification. Of course, there are sometimes discounts to be had for a canny buyer and also for fleet buyers. However, none of the truck makers make the price of their trucks readily available to the public. If you ask why this is of each truck manufacturer you will get a different answer.

The truth is that the subject is highly complicated – as are the trucks themselves.

We are no means suggesting that there is a whiff of price collusion here – quite the opposite. The manufacturers had had their fingers burned in 2016 to the tune of over EU3 Billion, when the European Commission found that MAN, Volvo/Renault, Daimler, Iveco, DAF and subsequently Scania broke EU antitrust rules. To this day this remains the Commission’s largest anti-trust fine on record – eclipsing even VW’s ‘Dieselgate’ fine.

Leasing not purchase

The truth is that most new trucks are bought using some form of funding mechanism – usually in the form of a lease or contract hire. After the 2009 ‘credit crunch’, and the near disappearance of the banks from lending in the commercial vehicle market, truck makers swooped in to mop up the market for truck financial services. After this point, most trucks were financed by the vehicle manufacturers themselves – at least as far as the UK was concerned.

As a result, it is often simply the monthly payments that concern the truck operator, not necessarily the initial capital purchase costs. Obviously, the price of the truck has a bearing on the monthly amount, but the truck maker must also factor in the likely resale value at the end of the contract – typically four or five years.

Consequently, the setting of these rates depends on the manufacturer’s view of their vehicles in the market, but also what the market for used trucks will be like in five years’ time. Over the years, manufacturers have got it very wrong, with airfields full of white tractor units, all with a specification that no used truck buyer really wants. Picture the scene in the pricing offices in 2015 – would the analysts there have been able to forecast the global pandemic and its knock on effect on the used truck market?

Buyback Return Profile

Now we understand about the importance of a vehicle returning to the manufacturer after its ‘first life’, we can delve a little deeper. If a manufacturer has just done a deal for 100 white, 6×2 mid range cab and power tractor units and find themselves quoting for another 100 with exactly the same specification and duration, would they be as keen to price that business as sharply as the first deal? If the deal was for some tippers or rigids, then this may make the deal a little sweeter.

Value Added as a Service

With the complexity of trucks increasing, so too does the service offering. It is rare these days that a new truck that is sold on finance does not have the accompanying repair & maintenance agreement (R&M). This is another monthly amount that is a pricing tool for selling new trucks – the operator will look at the total amount they are paying including maintenance.

In addition, there are the connectivity charges for online operation. These enable the connected truck to ‘radio in’ any technical issues and much more. Sometimes these are bundled into the deal, other tiles they will carry a cost.

Factory Output

If your factory is unable to make enough trucks to meet the demand, it is unlikely that the truck maker is going to be selling what little supply they have too cheaply. There have been a number of occasions only recently when this has been the case. Most notably during factory closures at the start of the Covid lockdown, but also for certain manufacturers at the onset of the Ukrainian war. MAN struggled here as their wiring looks for many of their trucks were made there and resulted in a factory shut down. The global semiconductor shortage has been plaguing the truck industry in the same way as cars, although this situation is starting to ease.

The converse can also be the case, where the factory wheels need to keep turning, so the sales operation have to sharpen their pricing pencils to get the trucks sold that the factory needs to make.

Sales Targets

This leads to sales targets. We all have them, whether it is the individual sales person’s target, the dealership target, or the national truck importer’s targets, if we are ahead, the pricing pencil is blunter than if we are well behind target.

Size of Order (Potential Order)

Like most things in business, if you buy one of something once, the price will be higher than if you agree to buy 100 of them every week. Sometimes the price for one may reflect the business potential you have (you actually use 1,000 of these things a week and just want to try one).

The same principle must surely apply to trucks – the price will depend on who you are and how many you want.

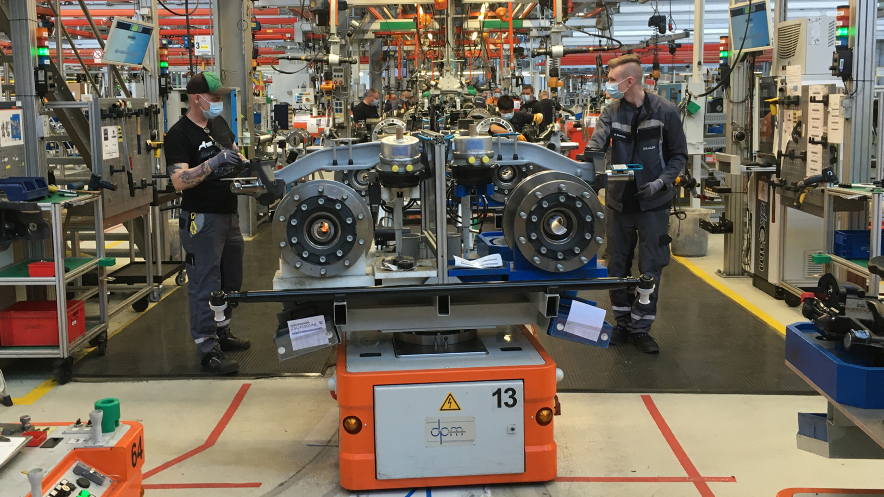

Truck Complexity

If you have ever used a ‘Car Configurator’ online to specify a new car just to see how much it would cost, then you will understand that most manufacturers offer a plethora of optional extras for the vehicles. Each selection of an option or group of options impacts the price. Now consider the complexity of a truck. Like cars there is the choice of engine, but it continues with wheelbase length, power take offs. Choice of three or four gearbox types, axle configuration, 4×2, 6×2, 6×4 etc even within one axle configuration such as 8×2, there is a choice of where the axles are placed – traditionally or as a tridem? Should the axles lift? Should they steer? Now consider the ‘off road’ options that can increase ground clearance, add stronger bumper components. How about size of cab? Most manufacturers offer at least five per model range. All of these variations and we haven’t even mentioned the interior trim, safety gadgets, connectivity, cab bunk configuration, colours, fuel tank size, rear axle ratios.

With something as unique as this, how can a manufacturer advertise a generic price for these? You could argue that a base price could be given for an agreed standard configuration – say a 4m wheelbase 6×2 mid lift tractor unit with a decent sleeper cab average horsepower – like a 460 or a 480. That would require the manufacturers to agree on this specification. However, given the history above, if you were in their shoes, would you go nowhere near having that conversation with other manufacturers? Probably not.

Get a Quote

So, if you are in the market for a new truck, then it is worth speaking in detail to a number of the manufacturers, as they may be of enormous help in terms of the specification you actually need, rather than the one you are looking for.

Their job is to listen to the type of work you have for the truck, and the problems you have experienced with existing vehicles and to make suggestions about the best truck in their range for the job with the best configuration. This may well differ to the specification you had in mind, but would mean that you can carry out the job more effectively.

Of course they want to sell you a truck, but it is in their interest to sell you the right truck. The salesperson sells the first truck, but the second truck is sold by the first, (and the service department, of course).