DAF Trucks continue to storm ahead in the UK’s new truck sales market, further increasing their market share compared to previous years. With the third quarter of 2022 showing DAF with a market share approaching almost one third means that practically one in every three trucks registered in the UK in 2022 was a DAF. This will have been helped by the launch of the new generation XG range and boosted by the fact that the trucks are assembled in the UK and therefore marginally less impacted by the effects of Brexit and exchange rates that impact the importers.

There has also been a reversal of fortune between Swedish rivals Scania and Volvo with Volvo outselling Scania this year and increasing their market share by almost two percentage points. At this point last year, Mercedes Trucks have performed less well this year. Going back to this time last year, the company was just 240 registrations behind Volvo – this year, Mercedes are almost 1,300 registrations behind the second place player.

ROle reversals too with the smaller manufacturers – Iveco have overhauled MAN, not thanks to any increase in their own market share, but down to the underperformance of MAN. This will be down to the issues that MAN experienced at the beginning of the year when their Ukrainian-made wiring harnesses could no longer be supplied because of the Russian invasion. Renault Trucks have improved their position compared to last year, closing the gap from 1,000 registrations to 500 registrations to their nearest rival in market share terms, MAN.

| Q3 | YTD | |||||||||

| Marque | Q3 | % Market Share | LY | % Market Share | % Change | YTD | % Market Share | YTD LY | % Market Share | % Change |

| DAF TRUCKS | 3234 | 32.2% | 2254 | 29.2% | 43.5% | 9307 | 31.7% | 8472 | 31.1% | 10% |

| VOLVO | 1394 | 13.9% | 1104 | 14.3% | 26.3% | 4544 | 15.5% | 3570 | 13.1% | 27% |

| SCANIA | 1351 | 13.5% | 946 | 12.3% | 42.8% | 4222 | 14.4% | 3853 | 14.1% | 10% |

| MERCEDES | 1256 | 12.5% | 1110 | 14.4% | 13.2% | 3227 | 11.0% | 3328 | 12.2% | -3% |

| IVECO | 819 | 8.2% | 723 | 9.4% | 13.3% | 2465 | 8.4% | 2345 | 8.6% | 5% |

| MAN | 836 | 8.3% | 607 | 7.9% | 37.7% | 2305 | 7.8% | 2513 | 9.2% | -8% |

| RENAULT TRUC | 633 | 6.3% | 521 | 6.8% | 21.5% | 1839 | 6.3% | 1558 | 5.7% | 18% |

| ISUZU | 255 | 2.5% | 196 | 2.5% | 30.1% | 756 | 2.6% | 643 | 2.4% | 18% |

| DENNIS EAGLE | 197 | 2.0% | 180 | 2.3% | 9.4% | 603 | 2.1% | 695 | 2.5% | -13% |

| FUSO | 59 | 0.6% | 73 | 0.9% | -19.2% | 136 | 0.5% | 294 | 1.1% | -54% |

| OTHER GERMA | 0 | 0.0% | 1 | 0.0% | -100.0% | 0 | 0.0% | 1 | 0.0% | -100% |

| 10034 | 100% | 7715 | 100.0% | 30.1% | 29404 | 100.0% | 27272 | 100.0% | 8% | |

The Market Overall

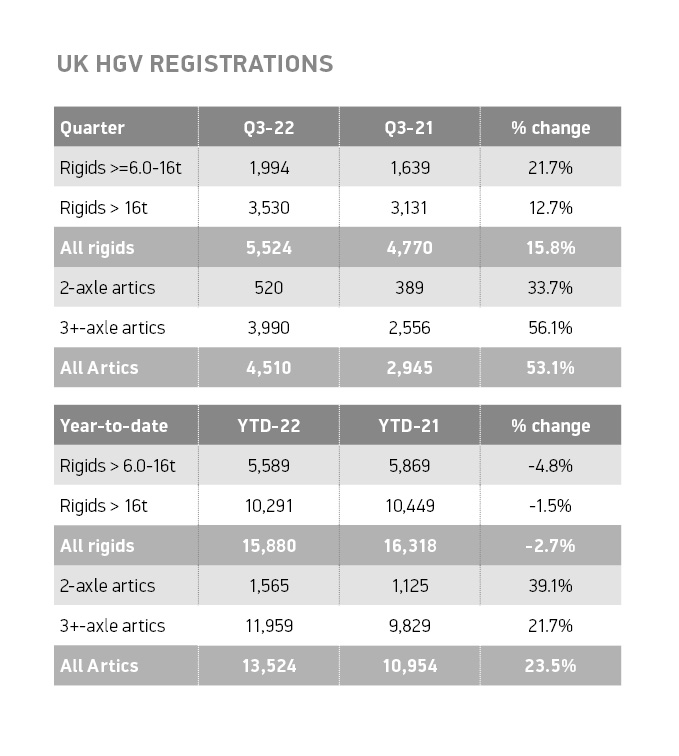

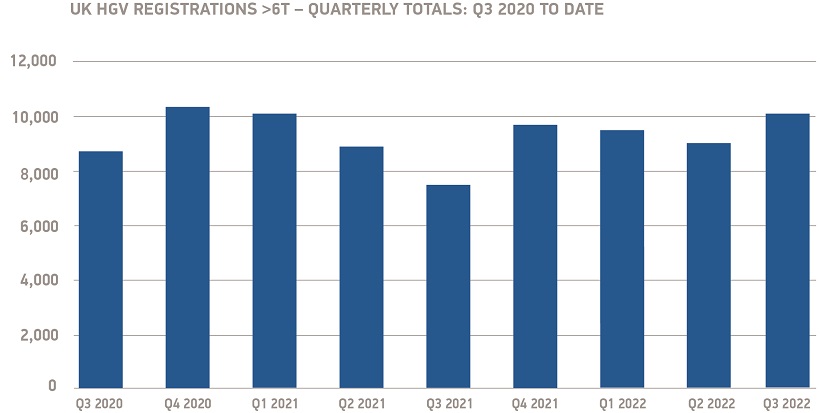

New UK heavy goods vehicle (HGV) registrations increased by 30.1% in the third quarter of 2022, according to the latest figures published today by the Society of Motor Manufacturers and Traders (SMMT). The surge saw 10,034 units registered across the three months, demonstrating the best quarterly growth since Q3 2021 and driving volumes up 17.3% on Q3 figures in 2019 pre-pandemic.

The robust third quarter growth was driven by strong demand for both artics and rigid trucks, up 53.1% to 4,510 units and 15.8% to 5,524 units respectively. There were notable increases of 56.1% for trucks with three or more axles, and 33.7% for two axle models. Rigids also posted growth, predominately within the 6-16T sector, which recorded a 21.7% increase, while >16T vehicles saw a slightly more modest rise of 12.7%.

Meanwhile, tractor units continued their strong performance across 2022 with deliveries up 53.2% to 4,409 units and accounting for 43.9% of the market. Box vans followed closely behind, with a 46.7% increase.

Across the UK nations, HGV deliveries varied considerably but most noted increases. Almost nine in 10 new trucks (88.5%) were registered in England, which recorded the strongest growth, up 31.6%, while Wales saw the lowest increase at 2.7%. In Scotland and Northern Ireland, the HGV market rose too, up 29.8% and 13.9% respectively.

The strong third quarter performance saw the market overcome the weaker first half of the year, driving up overall year-to-date volumes by 7.8% to 29,404 units. This is despite ongoing semiconductor and raw materials shortages which have shown signs of easing this quarter, with deliveries rising as the holiday season approaches, however, this is down -18.4% on Q3 year-to-date 2019 figures.1

Mike Hawes, SMMT Chief Executive, said, “Large growth in the heavy goods vehicle market is welcome amid the myriad challenges facing the sector, and signs of supply chain issues finally beginning to ease deliver hope for a more positive 2023. To maintain strong momentum, solidify recovery and drive fleet renewal, essential for delivering cleaner air in our towns and cities, the government must focus on measures to help drive demand for decarbonised heavier vehicles. This means investment in charging infrastructure that is accessible for trucks and reflective of their growth, ahead of need, while also taking a technology neutral approach as we race towards 2040 and the goal for all HGVs to be zero emission.”