View Full 2023 Year Truck Sales Figures Here

Further Good News – Truck Market Growth Continues

Looking at the new truck registration statistics from the SMMT, anyone would think that the UK is performing well economically, rather than struggling under cost of living crisis with trade with the EU suffering and positions hard to fill in the labour market.

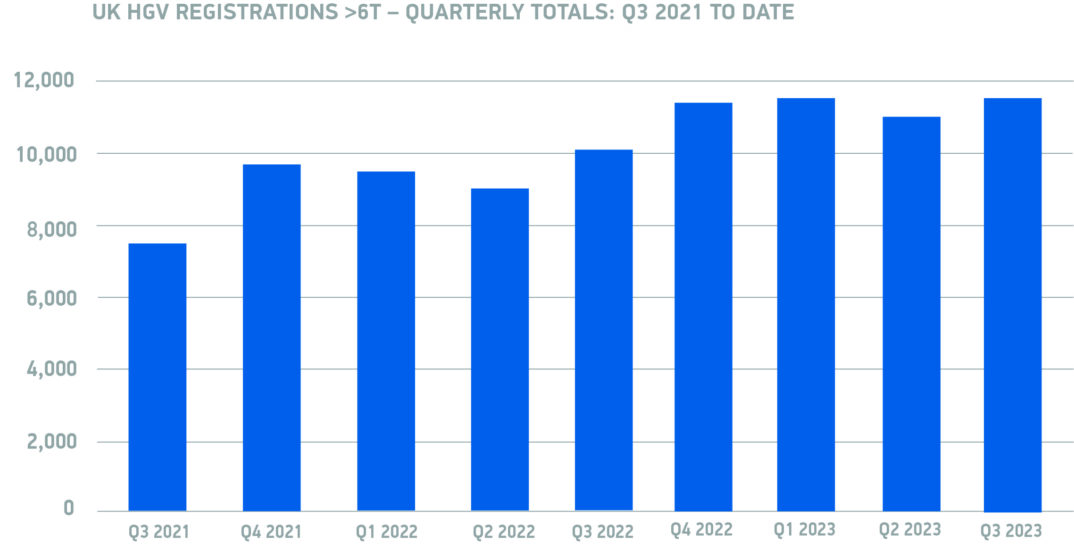

This is now the sixth quarter in a row that new truck registrations have increased – and by reasonable amounts as well, not just the odd percentage point here and there.

With tractor unit registrations up 16.1% over Q3 2022 and rigid trucks up 13.9% over the same period, nearly all segments of the industry are performing well. A sceptic may put this success down to a backlog in orders now coming through – it wasn’t so long ago that lead times were approaching twelve months for a new chassis thanks to the Ukraine war and semiconductor crisis. These figures will be impacted by this pent-up demand, the question is – to what extent?

One area of concern is the continuing poor performance of tipper trucks. These trucks that are primarily used in the construction industry are down more than 5% for the year so far and nearly 10% in the last quarter.

It is also worthy of note that, despite these recent growth rates, the market is still 5% behind the 2019 pre-pandemic levels.

Successful Truck Manufacturers in Q3 2023

In the third quarter of 2023 it was MAN’s turn to shine with registrations up nearly 40%. The backdrop to this is that MAN were hit the hardest of Europe’s truck makers as a result of the attack on Ukraine as many of the wiring looms were manufactured there closing the MAN factories for some time. This 40% growth is helping the business to make up their lost ground and helps to consolidate their fifth position in the UK market.

Once again, Scania performed well with Q3 up by 24.4% giving the company a growth of 32.4% for the first nine months of the year. This time last year, Scania were behind fellow Swedes Volvo, whilst their performance this year has eclipsed Volvo into third place.

The only slower player in the market in Q3 was Mercedes who were down 0.9% in a market up overall by 14.9%, although this was due to a solid performance in 2022 than a poor performance this year.

There is also some good news/bad news/good news this quarter. For the first time we see EV truck manufacturer Volta Trucks hit the registrations charts in the UK. So, it was only four trucks, but it was a start. This start was brought to a finish – perhaps only temporarily – as the UK trading company went into administration following the collapse of their battery supplier in October. The good news is that the business has been bought by an existing shareholder, Luxor Capital Group and may well hit the sales chart once more.

Let’s look at the manufacturers’ table for the first nine months of the year:

| Position | Marque | YTD 2023 | YTD 2022 | % Change |

|---|---|---|---|---|

| 1 | DAF | 10591 | 9307 | 13.8% |

| 2 | Scania | 5591 | 4222 | 32.4% |

| 3 | Volvo | 5007 | 4544 | 10.19% |

| 4 | Mercedes | 3775 | 3227 | 16.98% |

| 5 | MAN | 2853 | 2305 | 23.77% |

| 6 | Iveco | 2594 | 2465 | 5.23% |

| 7 | Renault Trucks | 2056 | 1839 | 11.8% |

| 8 | Isuzu | 895 | 756 | 18.39% |

| 9 | Dennis Eagle | 630 | 603 | 4.48% |

| 10 | Fuso | 226 | 136 | 66.18% |

| 11 | Volta | 4 | 0 | N/A |

| TOTAL | 34,222 | 29,404 | 16.39% |

The Best-Selling Truck Types 2023 Q3

The artic sector continues to grow at a pace, albeit starting to show early signs of slowing down. Q3 saw a 16.4% increase in tractor unit registrations against 18.4% for the first nine months. In the meantime, the growth in registrations of rigid trucks continues around the 14% mark, despite the underperforming tipper segment.

Mike Hawes, SMMT Chief Executive, said, “Britain’s sixth quarter of rising HGV rollout and increasing uptake of zero emission trucks this year underlines the sector’s strong position, with operators in all UK regions getting the latest fuel-efficient and very greenest models. The rate of zero emission truck uptake must increase, however, both drastically and soon – amid significant obstacles to the sector’s transition. With just one public HGV chargepoint in the UK, a national plan for public and depot infrastructure is urgently needed to make fleet decarbonisation a reality for all operators, now and in the long term.”