Half Year Results – Trucks are on a Roll

View Full 2023 Year Truck Sales Figures Here

More good news for UK Plc as far as new truck registrations are concerned – these registration figures have been historically good indicators of business confidence in the economic environment.

Nobody orders new trucks if they are expecting a significant downturn in business.

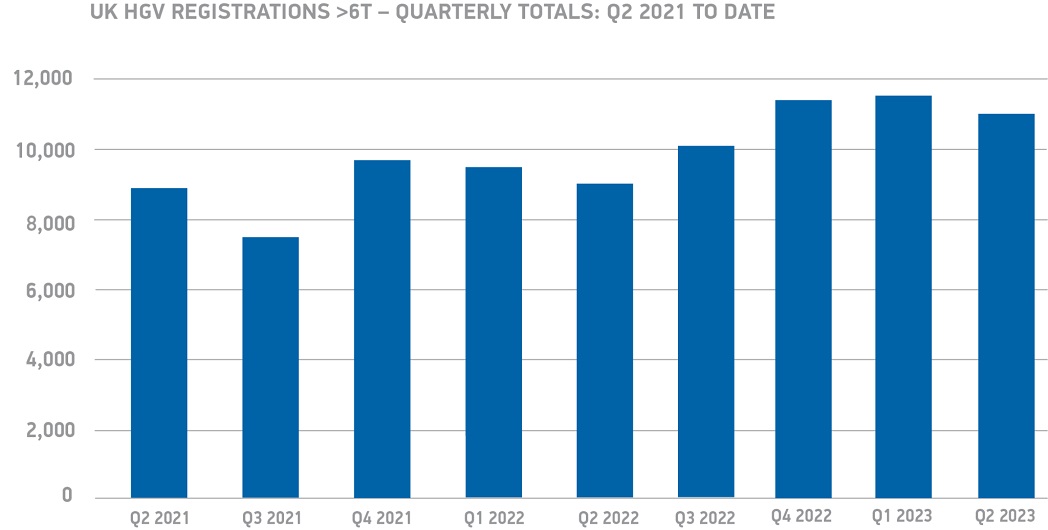

It is now the fifth consecutive quarter of growth in registrations of new heavy trucks over 6 tonnes GVW in the UK. This growth is represented across most industries with only tipping trucks normally used in the construction sector performing less well.

Successful Truck Manufacturers in Q2 2023

As far as the truck manufacturers were concerned, two manufacturers particularly stood out in the second quarter – Scania and MAN with growth rates of 48.8% and 43.6% respectively, whilst all other major manufacturers were behind the market average growth.

Looking at one quarter’s figures can be deceptive, as large fleet deals can often skew the picture. A more reliable view can be taken looking at the first six months of the year.

Let’s look at the manufacturers’ table for the half year:

| Position | Marque | YTD 2023 | YTD 2022 | % Change |

|---|---|---|---|---|

| 1 | DAF | 7161 | 6073 | 17.9% |

| 2 | Scania | 3911 | 2871 | 36.2% |

| 3 | Volvo | 3311 | 3150 | 5.1% |

| 4 | Mercedes | 2530 | 1971 | 28.4% |

| 5 | MAN | 1687 | 1469 | 14.8% |

| 6 | Iveco | 1659 | 1646 | 0.8% |

| 7 | Renault Trucks | 1316 | 1206 | 9.1% |

| 8 | Isuzu | 568 | 501 | 13.4% |

| 9 | Dennis Eagle | 361 | 406 | -11.10% |

| 10 | Fuso | 187 | 77 | 142.9% |

| TOTAL | 22,691 | 19,370 | 17.1% |

It is Scania that has had the best year so far – little surprise since the company’s announcement of Scania UK’s largest ever truck order of 2,500 trucks earlier on in the year. This has resulted in Scania taking second place from Volvo Trucks, whose growth appears sluggish in the first half of the year – at just 5.1% the company is well behind the market average of 17.1%.

Thanks to a strong first quarter, Mercedes have performed well, but their performance in the second quarter was less impressive but still resulted in a growth rate of 28.4% over last year.

The slower performers were Iveco and, unusually, Volvo Trucks. Volvo claim to have market leadership on electric trucks across Europe, but they still need to focus on their existing business.

The Best-Selling Truck Types 2023 Q2

It’s good news here too, as it is the artic sector that is growing the most quickly at present. Since the lead times for tractor units are typically shorter than for rigid trucks that have to have a body added, any increases in registrations are seen in this sector first. For the first half of 2023 tractor unit registrations are up nearly 20% with rigids up a healthy 14.8%. The only worrying element is the falling registrations of tipper bodied trucks in a growing market. This is concerning for the construction industry where most of these tippers are used.

Mike Hawes, SMMT Chief Executive, said, “HGV fleet renewal has flourished, finally beating pre-pandemic levels with five straight quarters of growth. Growing confidence for fleet investment is also translating into new zero emission truck demand, demand which must grow still faster if the UK’s green goals are to be achieved. Accelerating this transition, however, requires dedicated HGV charging and refuelling infrastructure and incentives to encourage uptake and depot upgrades. Doing so can help Britain become the world’s first decarbonised truck sector. There is no time to delay.”